japan corporate tax rate 2022

Legislative changes January 1 to March 31 2022. Offices or factories located in up to two prefectures.

Corporate Income Tax Definition Taxedu Tax Foundation

And b approximately 35 with a certain favourable rate for up to the first eight.

. Hence the effective statutory tax rate which was over 40 in the early 2000 s fell to 2974 in FY2019. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of Japan under Japanese income tax law. The national corporate income tax rate for large corporations with capital of 100 million yen or more was reduced from 30 in FY2011 to 232 in FY2018.

Each entity is a member firm of the PwC global network in Japan operating as a separate and independent legal entity. Last reviewed - 02 March 2022. These taxes are computed as a percentage of the national Corporation tax before tax credits and a per capita levy which is determined on the basis of the amount of capital and the number of employees.

Excluding jurisdictions with corporate tax rates of 0 the countries with the lowest corporate tax rates are Barbados at 55 Uzbekistan at 75 and Turkmenistan at 8. Corporate Tax Rate in Japan is expected to reach 3062 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Japan Corporate Tax Rate chart historic and current data.

Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax eg branch profits. Ltd PwC Tax Japan PwC Legal Japan and their subsidiaries. The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark.

Fifteen countries do not have a general corporate income tax. 21569 02969 140 USDCAD. MOF Ministry of Finance Japan Skip to Content.

Special local corporate tax. 2022 Corporate Tax Rates in Europe Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022. KPMGs corporate tax rates table provides a view of corporate tax rates around the world.

Data is also available for. And branch of a foreign corporation. Corporate Inhabitant taxes 2.

Japanese Public Finance Fact Sheet April 2021. The local corporate income tax rate was also reduced. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region.

Corporate tax amount is 10 million yen or less per annum and taxable income is 25 million yen or less per annum. Puerto Rico follows at 375 and Suriname at 36. The Outline proposes that if the total compensation paid to specified employees 2 in the current year beginning between 1 April 2022 and 31 March 2024 increases by 3 or more as compared to total compensation paid to specified employees in the previous year the excess of the current years compensation over the previous years compensation is eligible for a 15 to.

Corporate Inhabitant taxes hōjinjūminzei are local prefectural and municipal taxes paid in the prefecture and municipalities they have their offices. In the long-term the Japan Corporate Tax Rate is projected to trend around 3062 percent in 2022 according to our econometric models. 129895 -000380 -029 Corn.

Corporate Tax Rates and Legislation. In the case that a corporation voluntarily files the tax return after the due date this penalty may be reduced to 5. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident.

Film royalties are taxed at 15. Accounting updates January 1 to March 31 2022. Trade Statistics April 2022 Provisional ITN.

The combined nominal rate of corporation tax and local corporation tax national taxes is 2559 and the effective corporation tax rate national and local combined is. In the United Kingdom the standard statutory corporate income tax rate is due to increase from 19 percent to 25 percent on April 1 2023. The Policy of MOF.

Headline corporate capital gains tax rate. 216 rows Comoros has the highest corporate tax rate globally of 50. 79215 01295 166 home.

An already legislated corporate rate reduction is expected to progressively bring down the corporate tax rate to 2583 percent by 2022. Corporate income tax rates accounting status January 1 2019 to March 31 2022 Download a PDF. In 2000 the average corporate tax rate was 326 percent and has decreased consistently to its current level of 213 percent.

An under-payment penalty is imposed at 10 to 15 of additional tax due. Corporate Inhabitant taxes 1. Federal and provincialterritorial bills tabled or received royal assent in 2022.

Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen 20 of taxable income minus 427500 yen 695 to 9 million yen 23 of taxable income minus 636000 yen 9 to 18 million yen. A approximately 31 for large companies ie companies with a stated capital of more than 100 million yen. The rate is increased to 10 to 15 once the tax audit notice is received.

National Income Tax Rates. Interest Rate May 18 2022CSV2KB Tariff. It depends on companys scale location amount of taxable income rates of tax and the other.

Medium and small sized company. Current Japan Corporate Tax Rate is 4740. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

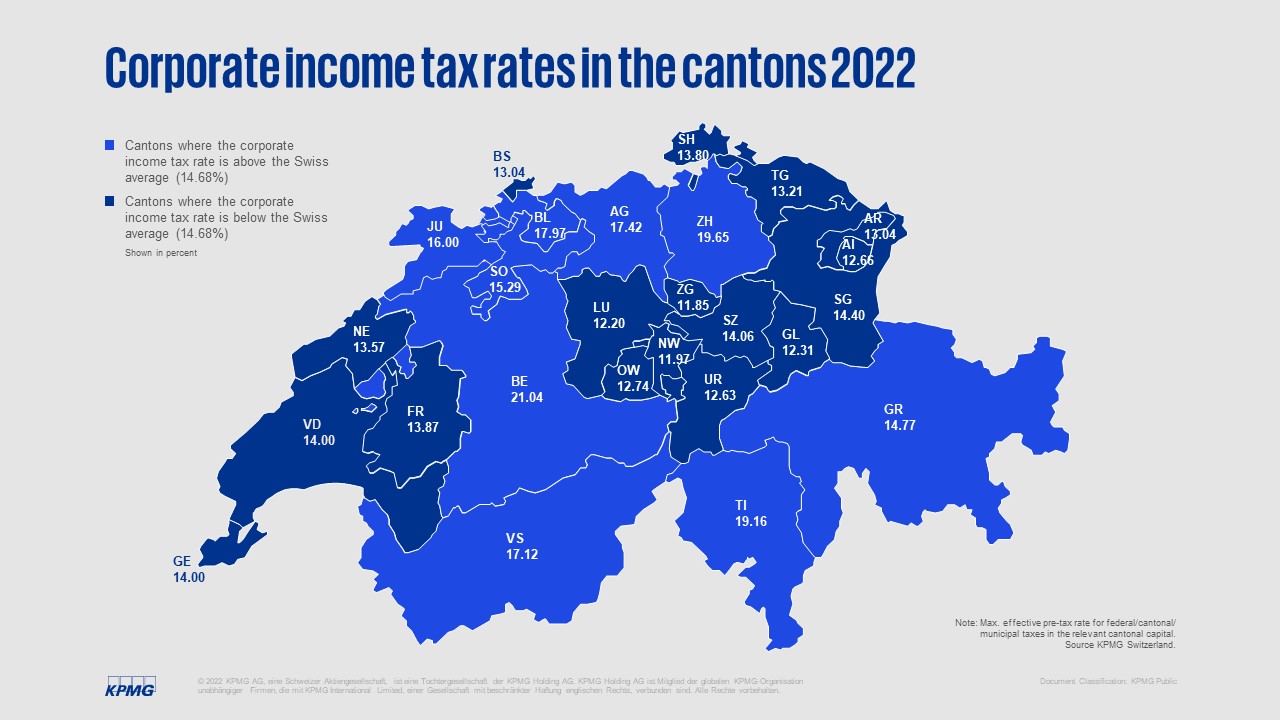

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

Capital Gains Tax Japan Property Central

Corporate Tax Reform In The Wake Of The Pandemic Itep

Tax Burden Soared Under Moon Administration

Corporate Income Tax Cit Rates

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Japan National Debt 2026 Statista

Japan Economic Outlook Deloitte Insights

일본 법인 세율 1993 2021 데이터 2022 2024 예상

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporation Tax Europe 2021 Statista

Corporate Income Tax Definition Taxedu Tax Foundation

Japan Cryptocurrency Tax Guide 2022 Kasō Tsuka Koinly

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000 2020 Historical Chart

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes